- #Moneydance vs moneyspire update#

- #Moneydance vs moneyspire manual#

- #Moneydance vs moneyspire software#

The information shown includes account balances, upcoming and overdue transactions and reminders, and exchange rate information.

I will definitely give it a spin within the next few months. Click on the image to see a full-size version. I may still pursue that route but time constraints prohibit me at this time. The runner up in this process is definitely GnuCash. They aren't the greatest either as they have hiccups regarding their updating process but for me, a person nearing retirement, there are several tools that will be helpful. For my portfolio, I've decided to go with Personal Capital. The downside is that they don't appear to be investment oriented regarding stocks although they have the capability. They have a youtube presence, not a large one but worthwhile videos to view. It's very inexpensive ($30) with no subscription or add on fees. It is how I would design an app if I could code. Some may see this as an odd choice but there are a few things that sealed the deal. Well, for anyone who finds themselves in my position regarding AceMoney or those who are curious as to what my investigation has resulted, the winner is: Moneyspire. Moneydance is a personal finance app that features strong support for transactions and bill pay, multiple currencies, account management, and investment tracking. There are also options that will allow you to connect it to your back account, but I didn’t want that anyways, so I import my transactions with a CSV.

#Moneydance vs moneyspire update#

There are options for automatically getting stock prices, to update your portfolios. Once you have your accounts set up how you want, you should be able to easily import your current data into GnuCash. It allows you to set up your account how you want, allowing you to generate reports that meet your needs.

#Moneydance vs moneyspire software#

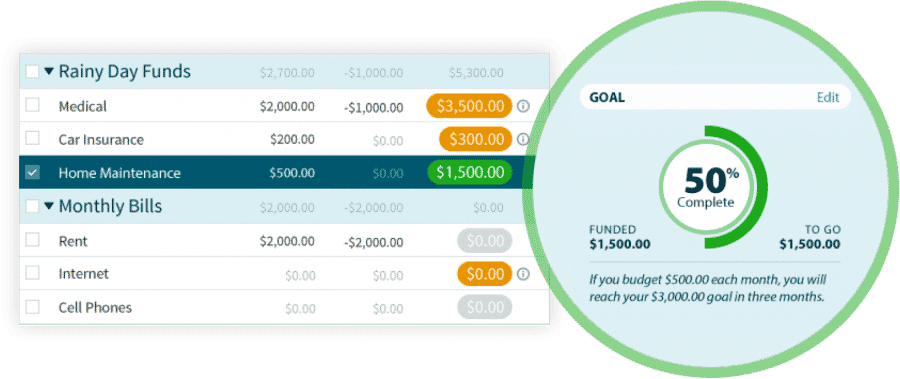

I like to know how much money I’ll have based on what I spend and this software will tell me my bank balance months in advance based on what I tell it I’ll be spending. There is a learning curve, but it is also flexible. Moneyspire is a good personal financial software application for making a home budget and analyzing where you spend your money. I highly recommend Moneyspire I've been using Moneyspire for some time now and found it to be the best personal finance software. You could also store them locally if you don’t want anything in the cloud. I store my data files in Dropbox so it’s always backed up and accessible from multiple computers. I first stumbled upon it looking for an offline option that doesn’t require bank connections. but damn, it’s fantastic and it’s free!!!

#Moneydance vs moneyspire manual#

It is not the prettiest software, and may require more manual entry, and will require a very basic understanding of double entry accounting (or willingness to learn), and there is no phone app. Never used AceMoney before, but if you want an offline software GnuCash is the way to go.

0 kommentar(er)

0 kommentar(er)